hat heartfelt plea to avoid speculating on railway shares came from John Ruskin's father in a letter to his son's future father-in-law, who had bankrupted himself with ill-advised purchases of railway shares. Robert Brownell, author of a book on Ruskin's failed marriage, explains the causes of the “successive bouts of this railway investment mania” that occurred in 1824-25, 1835-37, and again in the 1840s. The price of railway stocks had risen dramatically after “several soundly based schemes had given high returns on the investment“ (145). “By 1846 this had resulted in a fever of railway speculation with many more lines being floated than were feasible. One third of the total mileage of railways authorized between 1844 and 1847 was never built. Some schemes were undoubtedly fraudulent, others merely well advertised.” (145). A major cause of the railway bubble and subsequent crash derived from Parliament's failure to outlaw unsound economic practices that encouraged speculation:

The 1844 Railway Bill had not capped dividends at 10% and had allowed some railway companies to submit accounts which did not allow for depreciation on fixed assets. This resulted in continued public expectation of inflated profits and the promise of high dividends on shares, which in turn lifted share prices even higher. Railway Bills were rushed through Parliament in 1846 much faster than was sensible. Famously, the Board of Trade offices were besieged by railway scheme promoters on the last day for the submission of plans for the 1846 Parliamentary session. The share price bubble attracted thousands of new investors. Investment in the railways rose from less than £4m per year in the early forties to over £30m in 1847: a sum so staggering that it has been represented as 45% of total domestic capital investment.

Brownell explains one practice of the railway companies that attracted speculators — and that eventually almost destroyed the national economy: companies issued stocks for a small proportion of their actual price, “only calling up the remainder of the value of the share as the company progressed. . . . The get-rich-quick investor, anxious to make big money fast, would be more interested in rises in share prices than regular dividends. He would therefore be more tempted by the original issue which could be acquired for as little as £1 called, and sold at a profit later” (146). This practice, in key ways similar to the buying stocks “on margin” that led to the Great Depression of 1929, made the prices of individual shares, the stock market, and the entire economy particularly vulnerable to any drop in prices, since speculators, unable to afford the required payments, abandoned their shares, driving prices down precipitously.

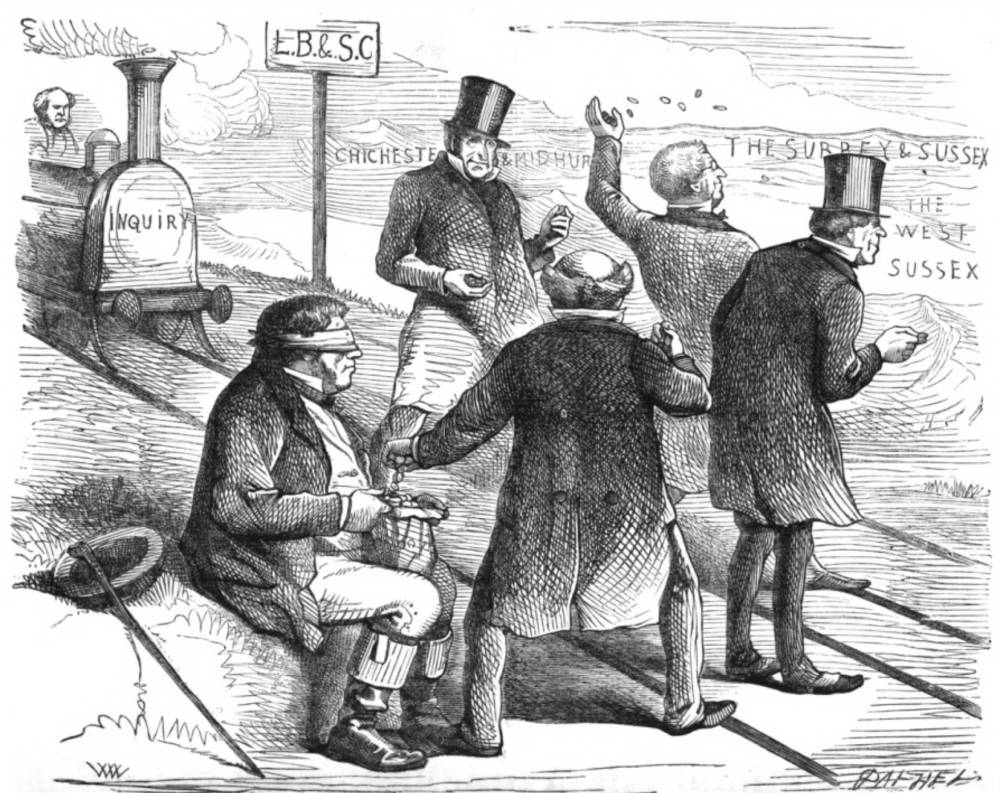

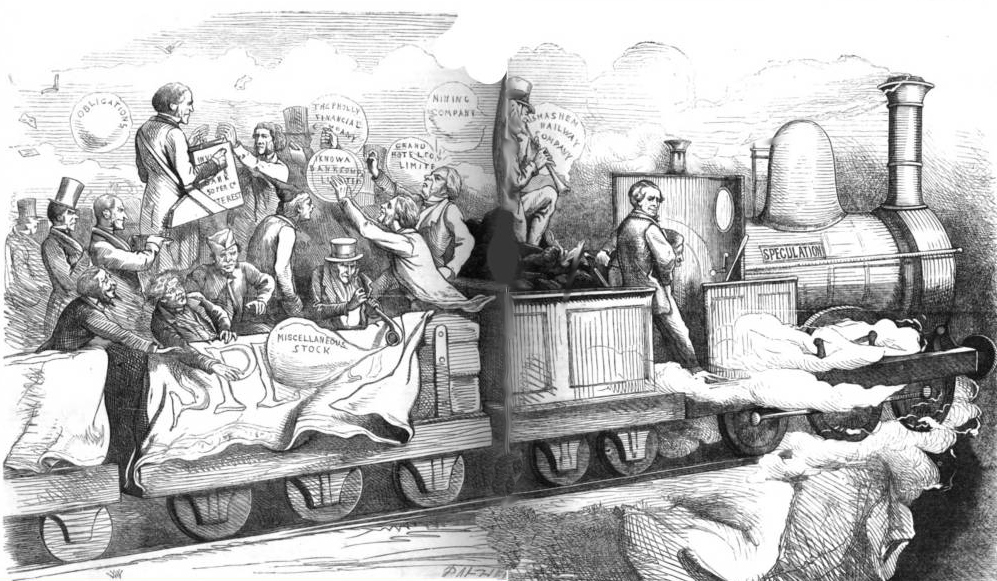

As these two editorial cartoons from the magazine Fun make clear, things had not improved all that much by the late 1860s. [Click on images to enlarge them and for the captions for each cartoon.]

Other contributing factors to the Perfect Storm that assailed Great Britain in the autumn of 1848 included the failure of harvests, the repeal of the Corn Laws, a negative balance of trade, skyrocketing interest rates, the consequent difficulty of obtaining loans, and well-meant regulations of the Bank of England.

A severe financial crisis had developed owing to the failure of the British and Irish harvests two years running and the general necessity of importing food. Imports such as Russian wheat had to be paid for in bullion, which depleted the Bank of England reserves. This in turn severely limited the amount of cash in circulation because this was linked to the gold reserves by an Act of Parliament specifically designed to prevent speculative bubbles. The result was that interest rates began to rise to unprecedented heights and, starved of credit, the railway companies called in the remaining balance on their shares. The repeal of the Corn Laws and the prospect of a good harvest resulted in the Corn Bubble collapsing which caused mass failures of corn speculators and in the general scramble for currency, commercial failures rocketed, leading to rhe threat that financial institutions would default. Four banks failed. . . . This crisis would come to be known as the 'October Panic'-or 'the week of terror', when the entire financial system came close to meltdown. [147-48]

Related Material

Bibliography

Brownell, Robert. Marriage of Inconvenience. Euphemia Chalmers Gray and John Ruskin: the secret history of the most notorious marital failure of the Victorian era. London: Pallas Athene: 2013 [Review in the Victorian Web ].

Last modified 9 February 2016